Employee Stock Ownership Plan

[read_meter]

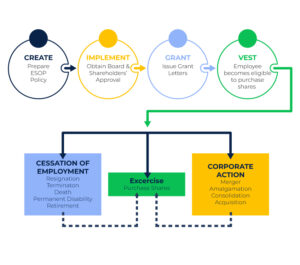

Companies frequently include stock in compensation packages so employees can benefit from the company’s success. The purpose is to provide team members with an upside remuneration by working together to raise the company’s value.

A pool of shares is typically set aside for employees in private enterprises. A new issue of company shares is represented by a legal document that the board of directors has signed. Stock options are the right to purchase a predetermined number of company shares at a specified price, often known as the grant price, strike price, or exercise price. You can profit from the difference if the stock’s value increases, as your purchase price will remain constant. If you hope to purchase and sell your stock someday, accepting your stock option agreement is the first step you have to take. Getting the deal doesn’t cost anything, and you’re not obligated to exercise your options. By accepting it, you’re simply allowing yourself to exercise in the future.

Stock option agreement

Companies will also include vesting strategies for employees in stock options agreements. Vesting means you have to earn your employee stock options over time. Companies do this to encourage you to stay with them and contribute to the company’s success over many years.

Stock options can be a great way for you to get shares of stock at a good price when you work at a high-potential firm. Ideally, the strike price of your options will remain the same, as the company’s stock value increases. In other words, you can get a great deal on shares of stock that are becoming more and more valuable!

Let’s take a look at an example to see how it works:

You are hired by a startup firm, and as part of your employment agreement, you are given the option to purchase 10,000 shares of the startup company’s common stock at a price of $1 per option under the company’s stock option plan. Your options are subject to a four-year vesting term with a one-year vesting cliff, as outlined in the stock option agreement. This implies that before you have any right to exercise 2,500 options, you must work for the company for a full year (25 percent of your total 10,000 options granted). Over the next 36 months, the remaining 7,500 options you were awarded will become exercisable. Up until all 7,500 of the remaining options are fully vested, 1/36 (or 208 choices) of the remaining options will vest each month.

Your one-year vesting cliff prevents you from receiving any of the options if you leave the company or are fired before the conclusion of your first year. Even if the value of the company’s stock has increased significantly after your options were vested, you are still permitted to exercise them at the guaranteed strike price of $1 per option. You now possess the option, but you are not required to exercise it unless you choose to. If you have been employed by the company for the entire four years, all 10,000 of your option shares will become vested. The company succeeds to the point that it is bought out or goes public. Stock in the company is now worth $25 per share. You purchase 10,000 shares for $10,000 (10,000 x $1) when you exercise your stock options. You then decide to sell all 10,000 shares for $250,000 (10,000 x the publicly traded price of $25 per share), netting a neat $240,000 profit.

Contact us

Good to have you here! If you have any queries, please leave your message. Our team will reach out soon:)

.