How to Build a Fund Deck That Will Wow Investors: Tips and Tricks

Investors play a crucial role in the success of any fund. To attract their attention and secure their investment, it is essential to build a fund Deck. A fund deck is a presentation that showcases the fund’s investment thesis, strategies, track record, and team. In this article, we will guide you through the process of how to build a fund deck that will wow investors. Let’s dive in!

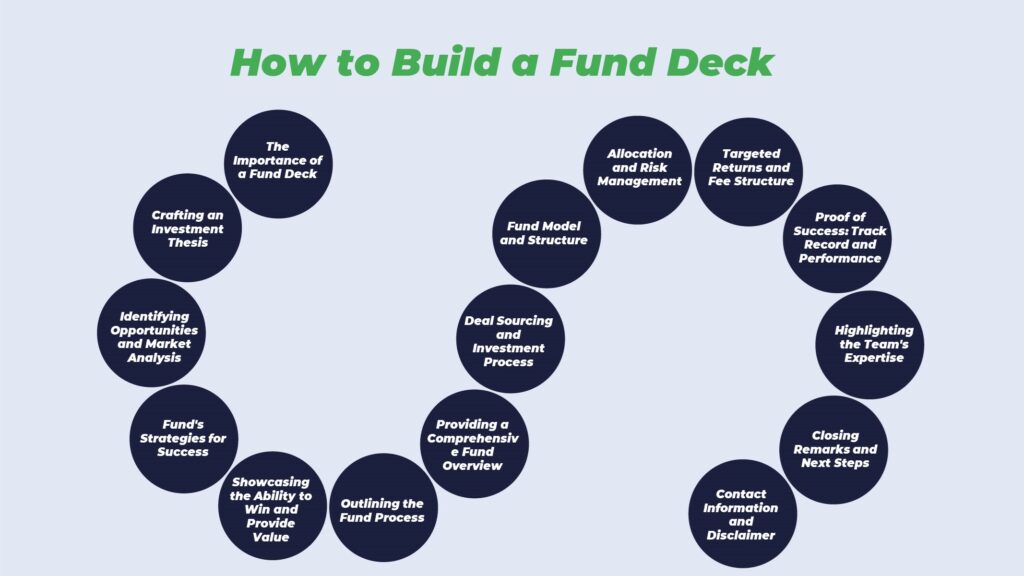

- The Importance of Build a Fund Deck

- Crafting an Investment Thesis

- Identifying Opportunities and Market Analysis

- Fund's Strategies for Success

- Showcasing the Ability to Win and Provide Value

- Outlining the Fund Process

- Providing a Comprehensive Fund Overview

- Deal Sourcing and Investment Process

- Fund Model and Structure

- Allocation and Risk Management

- Targeted Returns and Fee Structure

- Proof of Success: Track Record and Performance

- Highlighting the Team's Expertise

- Closing Remarks and Next Steps

- Contact Information and Disclaimer

- FAQs

- Conclusion

The Importance of Build a Fund Deck

A fund deck is your chance to make a memorable first impression on potential investors. It serves as a concise and visually appealing overview of your fund’s key elements. A well-crafted fund deck not only showcases your fund’s potential but also communicates your expertise and professionalism. Let’s explore the essential components of build a fund deck.

Crafting an Investment Thesis

Your investment thesis is the foundation of your fund deck. It outlines your fund’s overarching investment strategy and approach. Clearly define your fund’s objectives, target market, and key investment principles. Use this section to highlight your fund’s unique value proposition and how it differentiates itself from competitors.

Ready to raise capital and attract investors for your business? Easy Capraise is here to help! Our experienced team specializes in guiding businesses through the entire process of capital raising, from creating fund decks to crafting compelling pitch decks. Don’t miss out on investment opportunities – contact us today and let’s take your business to new heights! We help you to find your ideal investor!

Identifying Opportunities and Market Analysis

In this section, provide an in-depth analysis of the market you are targeting. Identify growth opportunities, market trends, and potential risks. Show investors that you have a comprehensive understanding of the market dynamics and how your fund will leverage them to achieve success.

Fund’s Strategies for Success

Outline the specific strategies your fund will employ to generate returns. Discuss your approach to portfolio construction, asset allocation, and risk management. Present your investment philosophy and showcase how it aligns with the current market conditions and your fund’s objectives.

Showcasing the Ability to Win and Provide Value

Investors want to know how your fund will add value to their portfolios. Highlight your competitive advantage, whether it’s your team’s expertise, proprietary research, or unique access to deal flow. Illustrate past successes and demonstrate how you have consistently outperformed the market.

Outlining the Fund Process

Walk investors through your fund’s investment process. Explain how you identify potential investments, conduct due diligence, and make investment decisions. Provide a transparent overview of your process to instill confidence in your investment approach.

Providing a Comprehensive Fund Overview

Offer a detailed overview of your fund, including its structure, fund size, and target investor base. Discuss any specific investment restrictions, if applicable. Be clear about your fund’s focus areas and investment horizons to align with investors’ expectations.

Deal Sourcing and Investment Process

Detail how you source investment opportunities and evaluate them. Highlight your team’s network and relationships within the industry. Showcase your rigorous selection criteria and the steps involved in making investment decisions. Transparency and a systematic approach are key here.

Fund Model and Structure

Explain the fund’s organizational structure, including the general partner (GP) and limited partner (LP) relationships. Discuss the fund’s fee structure and any performance-based incentives. Transparency is vital in this section, as investors will want to understand how the fund’s interests are aligned with theirs.

Allocation and Risk Management

Describe your approach to portfolio allocation and risk management. Highlight how you monitor and mitigate risks to protect investors’ capital. Emphasize the strength of your risk management team and the tools and systems you have in place.

Targeted Returns and Fee Structure

Clearly communicate the expected returns for your fund and the time horizon for achieving them. Discuss your fund’s track record and how it aligns with the projected returns. Additionally, provide details about your fee structure, including management fees and carried interest.

Proof of Success: Track Record and Performance

This section is crucial for gaining investors’ trust. Showcase your fund’s track record and performance history. Include relevant financial models, such as return on investment, annualized returns, and any benchmarks used for comparison. Provide visuals, such as charts and graphs, to make the data more accessible.

Highlighting the Team’s Expertise

Introduce your team members and highlight their experience and expertise. Investors want to know they are partnering with a skilled and knowledgeable team. Include brief bios emphasizing their relevant backgrounds and accomplishments.

Closing Remarks and Next Steps

In your closing section, summarize the key points of your fund deck and reiterate the benefits of investing in your fund. Encourage potential investors to take the next steps, such as scheduling a meeting or requesting additional information. Create a sense of urgency and excitement about the opportunity.

Contact Information and Disclaimer

Provide your contact information, including email and phone number, for potential investors to reach out to you. Additionally, include a disclaimer to ensure compliance with legal regulations and inform investors about the risks associated with investing in your fund.

FAQs

Can I use a template to build a fund deck?

While templates can be a helpful starting point, it’s crucial to customize your fund deck to reflect your unique value proposition and investment strategies. Tailor the content to your specific fund and target audience.

How long should a fund deck be?

A fund deck should be concise and focused. Aim for a length of 10 to 15 slides or pages, ensuring that you provide sufficient information without overwhelming investors.

Is it necessary to include a track record in the fund deck?

Including a track record is highly recommended as it demonstrates your fund’s performance history and gives investors confidence in your ability to deliver returns.

Should I hire a professional designer to create my fund deck?

While professional design can enhance the visual appeal of your fund deck, it is not mandatory. Focus on creating clear and visually appealing slides or pages that effectively convey your message.

What should I do after presenting my fund deck to investors?

After presenting your fund deck, be prepared to answer questions and provide additional information as requested. Follow up with potential investors and maintain open lines of communication throughout the due diligence process.

Conclusion

Build a fund deck that impresses investors requires careful planning and attention to detail. By following the outline provided in this article, you can create a compelling fund deck that effectively communicates your fund’s value proposition, strategies, and track record. Remember to adapt the content to your specific fund and audience for the best results.

Related Articles

Contact us

Good to have you here! If you have any queries, please leave your message. Our team will reach out soon:)

.